portland oregon sales tax 2019

425 max to sell a home in Salem and Bend. The companys gross sales exceed 100000 or.

11 Best Neighborhoods In Portland Oregon

Jul 24 2019 In May 2019 Oregon imposed a new 057 tax on Oregon gross receipts above 1 million that is set to go into effect for 2020.

. Portland Tourism Improvement District Sp. This is the total of state county and city sales tax rates. Did South Dakota v.

Method to calculate Portland sales tax in 2021. Barbara Roberts sits for an interview in her home in Southeast Portland on May 28 2019. Many other states are formalizing guidance through laws and regulations regarding collecting sales tax on online sales.

Average local rates rose the most in Florida jumping the state from the 28th highest combined rate to the 22nd highest. Wayfair Inc affect Oregon. On the other hand the income taxes in oregon are quite high.

Once you have verified you are exempt no. The tax will apply to tax years beginning on or after January 1 2019. There are no local taxes beyond the state rate.

The Oregon state sales tax rate is 0 and the average OR sales tax after local surtaxes is 0. CES imposes a 1 surcharge on the retail sales within Portland of certain large retailers. The New Oregon and Portland Taxes on Gross Receipts.

Tax rates last updated in January 2022. The minimum combined 2022 sales tax rate for Portland Oregon is. The Portland sales tax rate is.

127 rows Neither Anchorage Alaska nor Portland Oregon impose any state or local sales taxes. Of Oregons lack of a sales tax. Oregon is one of five states with no statewide sales tax but Oregon law still allows municipalities or cities to enact their own local sales taxes at their discretion.

The state sales tax rate in Oregon is 0000. While many other states allow counties and other localities to collect a local option sales tax Oregon does not permit local sales taxes to be collected. Fast Easy Tax Solutions.

Josh Lehner a senior economist with the Oregon Office of Economic Analysis compared the citys clean energy tax to Measure 97 a state business tax initiative that went before voters in 2016. For the tax years beginning on or after January 1 2016 January 1 2017 January 1 2018 and January 1 2019 this tax is 28 percent of the total Oregon Weight-Mile Tax calculated for all periods within the tax year. The cities and counties in Oregon do not impose any sales tax either.

2022 Oregon state sales tax. March 5 2019. Portland Oregon Sales Tax 2019.

Ashland for example has a 5 local sales. For example under the South Dakota law a company must collect sales tax for online retail sales if. The state sales tax rate in Oregon is 0000.

Business Tax Administrative Rule 50019-2. Its just the opposite of its state neighbor to the north Washington which has a high sales tax but has no state income tax. The minimum combined 2022 sales tax rate for Portland North Dakota is.

Combined with the state sales tax the highest sales tax rate in Oregon is NA in the cities of Portland Portland Salem Beaverton and Eugene and 102 other cities. There are six additional tax districts that apply to some areas geographically within Portland. Ad Find Out Sales Tax Rates For Free.

Oregon Sales Taxes. Over 2000 homes sold. What is the sales tax rate in Portland North Dakota.

The North Dakota sales tax rate is currently. The Portland sales tax rate is NA. View County Sales Tax Rates.

The Oregon sales tax rate is currently. Certain business activities are exempt from paying business taxes in Portland andor Multnomah County. Former Oregon Gov.

State and Local Sales Tax Rates Midyear 2019 Tax Foundation July 10 2019. Business Tax Administrative Rule 50019-1 Clean Energy Surcharge CES - Utility. The Portland Oregon sales tax is NA the same as the Oregon state sales tax.

On November 6 2018 Portland voters passed Measure 26-201 which imposes a 1 gross receipts tax on large retailers. The Portland sales tax rate is. Even though Oregon has no state sales tax Kiplingers 2011 10 Tax-Unfriendly States for Retirees selected.

The five states with the highest average local sales tax rates are Alabama 514 percent Louisiana 500 percent Colorado 473 percent New York 449 percent and Oklahoma 442 percent. The County sales tax rate is. View City Sales Tax Rates.

In may 2019 oregon imposed a. On February 21 2019 the Portland City Council passed Ordinance 189389 and Ordinance 189390 implementing the CES in. Last updated April 2022.

The company conducted more than 200 transactions to South Dakota. All businesses must register Registration form or register online If you qualify for one or more of the exemptions you must file a request for exemption each year and provide supporting tax pages. Instead of the rates shown for the Portland.

Oregon state cannabis tax revenue kept growing in the 2019 fiscal year which ended on June 30 topping 102 million a 242 percent increase over. Oregon is one of 5 states that does not impose any sales tax on purchases made in the state the others being Alaska Delaware Montana and New Hampshire. The tax applies to revenue from all retail sales of property and services not specifically exempted.

Corporations exempt from the Oregon Corporation Excise Tax. Did South Dakota v. Honolulu Hawaii has a low rate of 45 percent and several other major cities including Richmond Virginia keep overall rates modest.

What is the sales tax rate in Portland Oregon. Information about Portland Business License Tax Multnomah County Business Income Tax and Metro Supportive Housing Services. This great American city has plenty to offer visitors.

Sales tax region name. 2019 the Clean Energy Surcharge CES is imposed on businesses that have at least 500000 in Portland gross income and 1 billion in total gross income. City of Portland Revenue Bureau.

This is the total of state county and city sales tax rates. Oregon is another state with no statewide sales tax but it does have a high state income tax. NA Oregon has no state sales tax and allows local governments to collect a local option sales tax of up to NA.

The County sales tax rate is. 60 for MBA members 95 non-members. Exact tax amount may vary for different items.

However oregon does have a vehicle use tax that applies to new vehicles purchased outside of the state. Tax day freebies 2019 portland oregon coupons elf audi a4 deals uk babies r us coupons medela breast pumps. 2019 the Clean Energy Surcharge CES is imposed on businesses that have at least 500000 in Portland gross income and 1 billion in total gross income.

Doug Fir Lounge Cool Kids Kids Drink Specials

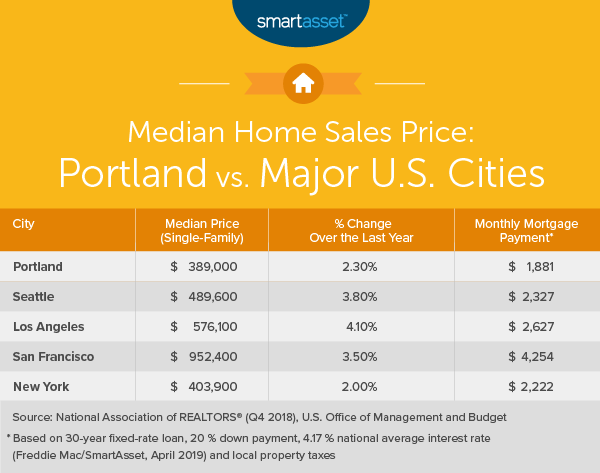

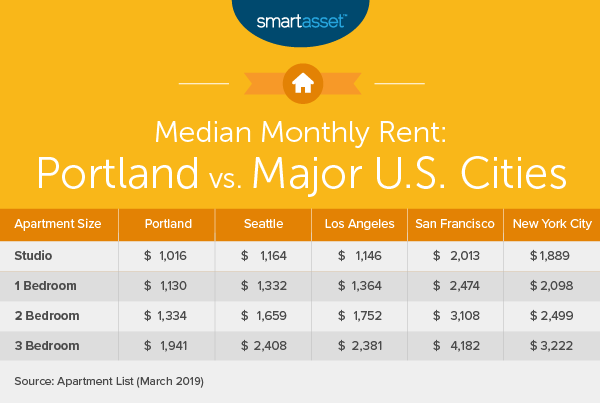

Cost Of Living In Portland Oregon Smartasset

How Tax Evasion Fuels Traffic Congestion In Portland City Observatory

What Living In Portland Is Like Is Moving To Portland A Good Idea

Pin On Moving To Portland Oregon

Oregon Enacts Two New Local Income Taxes For Portland Metro Multnomah County Primepay

Cost Of Living In Portland Oregon Smartasset

20 Honest Pros And Cons Of Living In Portland Oregon Tips

Best Shopping For Women S Fashion Near Portland Explore Trip South Portland

Hilton Suggests Travel Blog Portland Oregon A Weekend Getaway With The Kids

Badb Catha Supersonicart Lily Seika Jones Songs Of Or At Animal Art Fairytale Art Art

Portland Oregon Learn About Life In And Around Portland Or Usa Pela

Where To Live In Portland Oregon Living In Portland Oregon

Portland Oregon Travel Guide At Wikivoyage

10 Worst Neighborhoods To Live In Portland Oregon Living In Portland Oregon

City Guide Portland Oregon Go Next

Amazon Com Portland Oregon Zip Code Maps 48 X 36 Laminated Wall Map Office Products